Councils are worse than banks when it comes to dealing with hardship among ratepayers, an ombudsman’s report says.

Victorian Ombudsman Deborah Glass says there’s nothing new about council heavy handedness around unpaid rates.

However covid has highlighted ratepayer hardship as an issue councils will need to deal with going forward.

Her investigation found some cases of fair and reasonable practice among the state’s councils 79 councils – all of which had a hardship policy.

‘Paternalistic and punative’

However community advocates described them as “paternalistic, punitive and judgemental”, and the ombudsman found that only one in three councils made their hardship policies public.

Others had policies that didn’t reflect actual practices, and some didn’t tell residents they had hardship policies even when the resident said they couldn’t pay.

Councils also refused to exercise their right to grant waivers and deferrals and charged penalty interest to people in hardship.

“The public sector is expected to act in the public interest more than the private sector – but in dealing with hardship, local councils lag behind utility and other companies, including banks,” Ms Glass said.

“We would be rightly concerned if our bank was doing more to meet its social obligations than our council.”

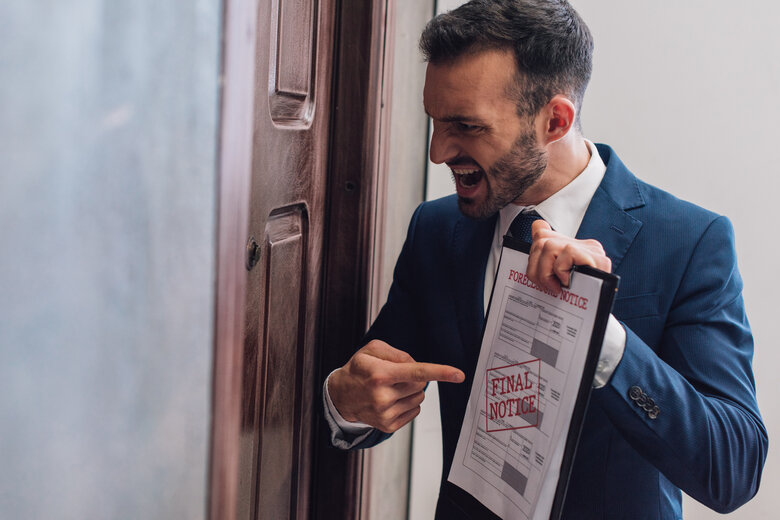

Debt collectors

Rates, which in 2019-20 ranged between $1,227 and $2,000, account for 34 to 79 per cent of council revenue, the report found.

Before covid, around one in 10 Victorians experienced some form of financial difficulty.

Under Victorian laws, councils have discretion to waive or defer rates in cases of hardship. However the Local Government Act doesn’t define hardship, leaving it up to councils to decide who qualifies.

Councils sued ratepayers for unpaid rates more than 7,000 times in 2018-19 and sold or transferred land for unpaid rates 28 times.

Ninety-seven per cent used debt collectors and ten per cent charge penalty interest.

It should be a matter of concern that banks and utility companies sometimes do more to meet social obligations than local councils.

Deborah Glass

Almost all councils offered interest waivers, but “a handful” limited the amount of interest they would waive.

The Ombudsman also reported cases where rate payers had accumlated huge amounts of interest, including one woman who found herself $47,000 in debt for rates and ongoing interest.

Finance officers conflicted

The report notes that councils rarely employ officers with experience in financial counselling or hardship applications.

The advocacy group Ratepayers Victoria also told the ombudsman that finance officers have an inherent a conflict of interest between compassion for ratepayers and protecting their budget for Council.

Ms Glass makes a number of recommendations including setting minimum standards for hardship relief for all councils and requiring them to publish hardship information on websites and rates notices.

She also proposes a cap on penalty interest rates and having a clear and consistent definition of hardship.

“Good practice is not consistent across all councils, and the sector as a whole is falling behind the private sector and government tax agencies,” Ms Glass said.

“It should be a matter of concern that banks and utility companies sometimes do more to meet social obligations than local councils.”

Comment below to have your say on this story.

If you have a news story or tip-off, get in touch at editorial@governmentnews.com.au.

Sign up to the Government News newsletter

In one year alone, our shire incorrectly gave 150 Ratepayers a bad credit rating. Clearly failing to the consumer code of credit which is 90 days.

Failed to issue a notice of discontinuance notice and disparaged any body that complained. In fact, targeted leading individuals in collaboration with other conflicting organisations.

Our Director of Corporate Services and along many of her financial team transferred with a pay rise to East coast of Australia and continue on as if nothing happened (One remains here). As a direct result, I know this whistle blower was minuted as vexatious and out of a job.

The CCC and Ombudsman only lead by making examples. (Kill the chicken to scare the monkeys).

Councils are not banks.

One of the responsibilities of land ownership is payment of council rates as they fall due for payment.

Why should other ratepayers who diligently pay their rates on time have to subsidize those who don’t. Financial hardship has varying degrees of severity and impact. How is it measured? It is to easy to claim financial hardship – with universal blame on events like Covid.

How does 1 person allow their rates to be $47k in arrears. How long have the rates been in arrears? How many properties does this person own?

Pensioners already receive rate subsidies.

No sympathy from this ratepayer. Pay on time, or bear the consequences!!

Council’s should not be expected to function as welfare organisations, as this is the role of Federal government. Can people claim hardship and not pay their PAYG income tax, of course not! Why is there a double standard expectation for local government? Just another cheap opportunity to put the boot into Councils.

Did you check your facts before dragging PAYG income tax? I know there was a time when you can claim hardship from the Tax Office and just like these councils, prefer not to make it public. Look forward to the day when your world crashes around you and you reach out for a helping hand.

Re Modern Slavery, the recent NSW Legislative Council Committee report makes it clear that the proposed NSW legislation will not extend to Councils. Instead there will be guidance and perhaps a Code. The NSW legislation has already passed its promised promulgation date, and has stalled.

What if we were smart and compassionate. A good council could employ one full time “RatesResolver”. So there is a $100K cost to council to say review $3M in unpaid rates. They check each case, see if the property owner can provide services to the council as a “one-off” barter. I.e you owe say $2000 and you are a landscape gardener. Council has a huge list of road, damage, parks damage, unattended council areas around streets and roads, have that ratepayer provide 40 x hours of “agreed” work, the “RateResolver” checks off the work, and the ratepayer is cleared of that year’s debt but the council saved $2000 since the cost of doing it internally is usually double due to cost of staff/vehicles/equipment wear and tear etc. Just a thought. Even if only $1 to $2M is recovered the council is ahead and there are better outcomes for all parties.