Rising mortgage stress is a key factor behind Australia’s decline in living standards, says a public policy think tank.

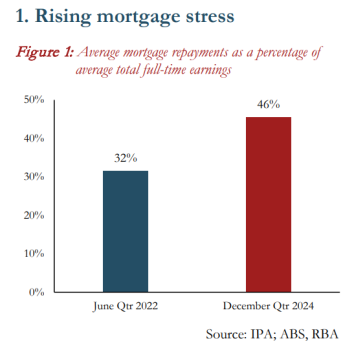

In a research document, the Institute for Public Affairs notes that a typical full-time worker in Australia is paying 46 per cent of their earnings as mortgage repayments – up from 32 per cent in 2022.

“A mortgage burden that rises so sharply over this brief time period highlights a sudden rise in financial stress and challenge to living standards,” says the IPA.

Elsewhere in the paper – Six more measures of Australia’s declining living standards – the IPA finds real net disposable income per capita declined by $954 between 2022 and 2024. Over the 2021-22 financial year, real net disposable income per person was approximately $75,672. By 2023-24 it was $74,718.

People are working more but earning less

Another measure of the country’s declining living standards is the number of Australians working multiple jobs. There were 100,000 more Australians working multiple jobs in December 2024 compared to June 2022, says the IPA, with the total number as of December 2024 tipping over one million for the first time.

“This sharp increase indicates that Australians are taking on extra work at the same time that real net disposable income per capita has declined. People are working more but earning less in real terms,” says the IPA.

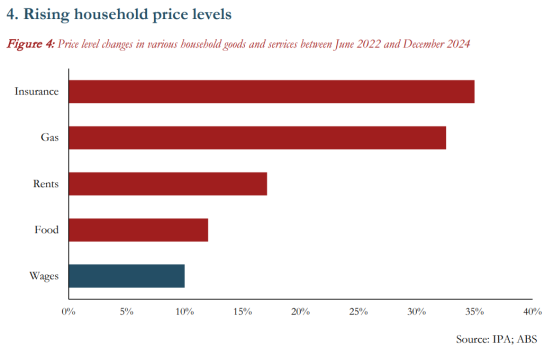

Sharp price rises are also contributing to Australians’ financial pain.

Between June 2022 and December 2024, price level rises in food and drink (up 12 per cent), gas and other household fuels (up 33 per cent), rents (up 17 per cent), and insurance (up 35 per cent), all exceeded wages growth (up 10 per cent).

Australians are also facing a rising tax burden. “On average, each Australian is paying more in taxes than before,” says the IPA. Indeed, between 2022 and 2024, per person tax revenue increased from $21,158 to $23,906 – an increase of $2,748.

“This can be explained by the effects of bracket creep and inflation, among other things. Rising wages pushes taxpayers into higher tax brackets, while rising price levels of goods and services incurs added tax through the GST,” says the IPA.

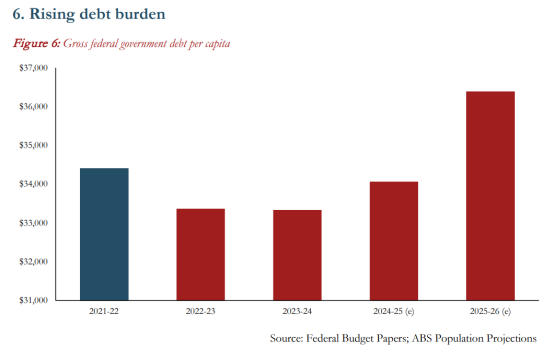

The sixth and final measure of Australia’s declining living standards is the country’s rising debt. Australia’s nominal federal debt is projected to increase from $895 billion in 2022 to $1 trillion by 2026. On a per capita basis, this rises from $34,416 to $36,388 per person.

“A higher debt load per individual means Australians may face greater financial pressures in the future, directly impacting living standards,” says the IPA. “Higher government debt levels means that Australians are likely to face higher taxes in the future – meaning diminished disposable income and added financial stress.”

Leave a Reply