There were 590 convicted cases of fraud against federal entities last year with fraud potentially costing the government $1.7 billion, a statistical report says.

The latest annual census of fraud against the Commonwealth by the Australian Institute of Criminology has found a large increase in fraud by external parties – at a time when the number of staff dedicated to fraud prevention is dropping.

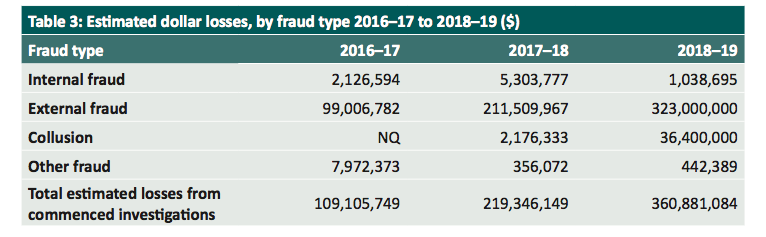

The report found that between 2017-19 the amount lost as result of fraud from customers, third party providers, vendors and members of the public increased by 73 per cent.

It found a 59 per cent decrease in money lost to internal fraud committed by government employees and contractors.

The AFP was investigating 105 fraud matters worth more than $1.2 billion in June 2019.

The report says it’s difficult to estimate the true cost of the fraud and says at the time of the action was detected the financial losses for 2019 were valued at $360 million – almost three times the estimated loss of $109 million in 2017.

Internal fraud resulted in losses of $2.7 million and external cost the government $146.9 million.

However, the AIC puts the overall potential loss for 2018-19 at $1.7 billion.

“On average, it was estimated that eight per cent of departmental resourcing could potentially have been affected by fraud, equating to $1.7 billion of total resourcing,” it says.

There were more than 1,100 fewer internal investigations in 2019 than in 2017, and 340,000 fewer investigations of external fraud.

All up, there were a total of 5,579 fraud investigations in 2019 compared to 350,291 two years ago.

Drop in fraud-focussed staff

The report shows that despite the increase in fraud there were fewer staff focused solely on fraud control in government agencies.

The number dropped dramatically from 1,873 to 646 between 2017-19.

The AIC survey found there are currently some 4,800 employees whose roles include “some aspect” of fraud control. However there were only 646 employees working exclusively on fraud across 22 out entities out of the 144 surveyed.

The most commonly reported barrier to better fraud detection was resourcing, increased workloads and competing priorities.

Misuse of ICT was the most common method of committing fraud in 2019.

“As with past years the primary area of risk with regard to internal fraud lay in the information held by entities and in the access that staff have to IT systems,” the report says.

It says in 2018-19 the number of internal fraud investigations involving information as the target increased by almost 33 per cent from the previous year.

Financial fraud posed the most common risk for external fraud.

Report also said the most harmful internal fraud perpetrators had been employed for more than seven years.

On average, fraud occurred over two years. The most common fraud control weaknesses were perpetrators overriding internal controls and lack of knowledge about fraud.

“On the cone hand the perpetrators know of the fraud controls in place and purposefully exploited them to their gain, while on the other hand some individuals were unaward of fraud controls and so were undeterred by the risk of detection,” the AIC says.

Comment below to have your say on this story.

If you have a news story or tip-off, get in touch at editorial@governmentnews.com.au.

Sign up to the Government News newsletter

One thought on “Potential cost of fraud against govt $1.7 billion”

Leave a comment:

Most read

Scathing report finds little has changed at PwC

Qld council welcomes progress on massive battery system

Inquiry to consider how federal govt can address councils’ sustainability issues

‘Local’ procurement turns out not to be so local, committee hears

Another report finds local government falling down on cyber security

The current LNP Government are fraudulently incompetent …show by their actions and in action.