Services and online interfaces delivered by Australian Government agencies are so cumbersome and frustrating that many people forced to deal with them would rather pay a professional to deal with the bother rather than risk the consequences of making a mistake.

That’s the resoundingly bleak takeaway from the first 9 weeks of sweat, focus groups and discovery sessions at the Digital Transformation Office as the agency prepares to issue a new prototype interface it claims “could radically improve usability” for online and digital services across all three tiers of government.

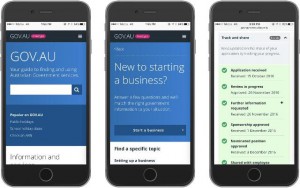

The DTO on Thursday used its Blog to release an update on its findings after 9 weeks, five of which have been spent building an Alpha prototype to validate its “hypothesis” that online interfaces for government should be built around customers and client ease of use rather than rigid departmental and agency structures.

That approach might be online canon in the corporate and retail worlds, but according to Leisa Reichelt, DTO’s Head of Service Design, users of government services are still struggling to figure out what it is that they need to do thanks to a legacy of clunkiness and complexity.

“We learned people often struggle to get a ‘mental model’ of everything that government needs them to know and do, because this information is often spread over several websites,” Ms Reichelt said.

“They feel they’re finding out what they’re required to do in just the nick of time, often through asking someone in their personal or professional network.”

The dominant ‘Mental Model’ at the moment seems to be paranoia.

People are so worried that they’re even prepared to part with money just to avoid the consequences of stuffing-up a government transaction – because if they do it come back and haunt them through a penalty, stopped welfare benefits or a vital regulatory approval being held up.

“We heard it was easier to pay for professionals to deal with the complexity of government. This was true for both young people and experienced professional across a range of domains including taxation, importing, and people looking for grants,” Ms Reichelt said.

“Many of these processes are perceived as very complex and people are very concerned about making a mistake in their dealings with government.”

The all too real fear of botching what would otherwise be a basic a tax return has for decades kept tax agents and customs brokers in business as a thriving industry of transactional intermediaries.

But that could soon change fast.

As customer experiences of transactional services like banks, online shopping, travel and entertainment become user friendly, government entities like Centrelink, the ATO and even local councils are increasingly feeling the heat from fed-up clients who now routinely apply the blowtorch through social media and scorching user reviews on the Apple App Store.

The Tax Office is one big agency that appears to be biting the bullet on customer service, with officials recently conceding that if automated improvements flow through, both tax returns and tax agents could ultimately no longer be needed for people with relatively simple financial affairs.

And while it’s still early days, the DTO reckons it’s moving towards taking its prototype based on the “two particular journeys” of “starting a business” and “the experience of coming to Australia to work” out of the Alpha stage sand pit and into Beta testing.

It might sound like a small achievement, and largely still is, but the real message Reichelt is pushing is that the got there in 9 weeks – rather than 9 months or in the case of some IT projects for bigger departments 9 years.

“We have more work to do – including an independent assessment to ensure we meet the Digital Service Standard before we can move onto the next stage of development – the Beta,” Reichelt said.

“We’ll publish the results of that Alpha assessment early next year.”

Comment below to have your say on this story.

If you have a news story or tip-off, get in touch at editorial@governmentnews.com.au.

Sign up to the Government News newsletter

This article has the unfortunate flavour of rhetoric that has been tried in the UK and is appearing to fail there and is likely to fail here. Even the ATO has embarked on recognition of the role of the intermediary.

No technology or better website interface removes the role of a competent professional who knows the law and knows how to apply it in helping a business person who wants to do business. Business people dont pay a professional just because a government website might be horrible to negotiate. The engage with a professional to help them navigate complex laws (that Australia has) because as a business person they dont want to learn or know those complex laws.

A competent professional will help a business person even if the government website is brilliant.

I encourage the DTO to bring a new era of government websites, information and communication into existence, but do so because it is needed to explain the complex laws. Dont keep trying the line that it will remove the need to engage an intermediary. Sorry but there isnt much simple about any business tax return, the tax law is too complex. That is just one example.

Yes I represent a community of those professionals: The Institute of Certified Bookkeepers is a community of professional bookkeepers who have the inclination (etc.) to understand the complexity of doing business and complying with Laws and assist business to do so.

DTO bring it on, but stop the unnecessary rhetoric about advisors. We are not the enemy to what you are doing!