Staff at NSW councils used council-issued credit cards to pay for entertainment, alcohol and parking fines without showing they were business-related, an audit shows.

An investigation of six councils by the NSW audit office found all had significant gaps in their credit card policies and procedures.

“Their reconciliation of credit card transactions needs to be enhanced to enable detection of potential misuse or fraud,” auditor general Margaret Crawford said.

Ms Crawford found all six councils had transactions that potentially raised questions about whether they were really business-related, including the use of them to pay for alcohol, entertainment and parking and traffic infringements.

This audit assessed the effectiveness of credit card management in six councils: Dubbo Regional Council, Junee Shire Council, Lane Cove Council, Nambucca Valley Council, Penrith City Council and Shellharbour City Council.

It found while their policies and procedures covered the main aspects of credit card use and management, “a lack of clarity in some areas could lead to inconsistent and inappropriate use of credit cards”.

These areas included eligibility to hold a credit card, aligning card limits with financial delegations, and reconciliation procedures.

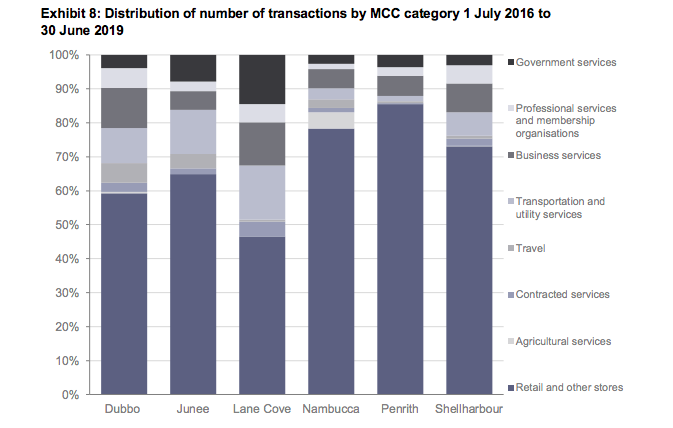

Retail expenditure most frequent

Retail and other stores accounted for the highest number of transactions for all six councils.

For the period 1 July 2016 to 30 June 2019, retail and other stores made up over three-quarters of all transactions by staff members of Nambucca Valley Council and Penrith City Council.

This category also accounted for over half of all transactions by staff members of Dubbo Regional Council, Junee Shire Council and Shellharbour City Council.

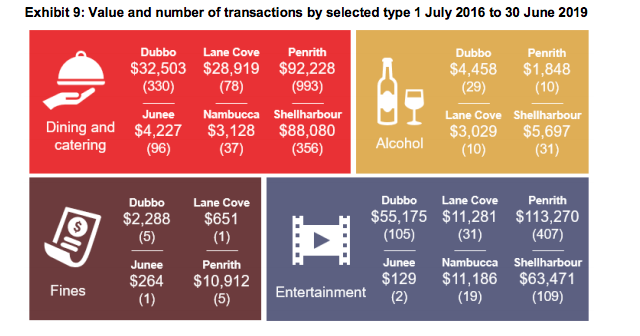

Government fines

Four councils used credit cards to pay for government fines, including Lane Cove, which used a credit card to pay a fine in breach of its own policy.

Penrith paid almost $11,000 in fines between 2016-2019 and Dubbo put $2,288 on council credit cards.

Incidents included:

• A cardholder at Dubbo Regional Council paid a $675 fine for using an unregistered vehicle. The council failed to show that the vehicle was council owned.

• A Junee Shire Council paid $264 parking fine. The reconciliation form said it was a community transport vehicle but didn’t record details of vehicle or incident.

• A cardholder at Penrith City Council made four fine payments, including two worth $1,656 for using a transit lane. The council identified the vehicle as an RFS vehicle but didn’t not follow the standard procedure of forwarding the penalty notices to RFS, resulting in further fines of $3,746 each.

“All councils should handle such transactions with caution, especially in terms of seeking details of the incidents and verifying the vehicles involved,” the audit said.

Reconciliation

The audit said reconciliations didn’t require evidence of business-related spending, even for alcohol or at entertainment venues.

Five of the six councils didn’t include compliance checks in their reconciliation process, including checking that all purchases were allowable.

The level of senior management involvement in monitoring credit card use also varied across the six councils, the report found.

Three of the six councils didn’t produce regular reports for oversight and by management and five of the six councils had no plans for internal audits or targeted reviews of credit card management and use.

Ms Crawford noted that there are no sector-wide requirements or policies around credit card by in local government in NSW and recommended that guidelines be developed and put in place by mid 2021.

The department of local government supported the recommendation, acting deputy secretary Monica Gibson said.

Comment below to have your say on this story.

If you have a news story or tip-off, get in touch at editorial@governmentnews.com.au.

Sign up to the Government News newsletter

Good afternoon Government News.

I am the CFO from Nambucca Valley Council. Not all Councils had used credit cards to pay fines and Nambucca Valley Council was one of those Councils that did not pay fines on credit cards. Your presentation of the diagram in Exhibit 9 is misleading as it omits the footnote at the bottom of that diagram in the report which states ‘The category ‘Entertainment’ may include conference registration platforms and library supplies such as DVDs.’

I was subject to an audit on my corporate credit card that was a blanket audit due to a question asked in the Victorian Parliament. That was over 20 years ago. I was one of many singled out over the credit amount ($25k back then) and referred to the purchase of alcohol supplied in catering costs. This included all emails. I had no issues but I learned a very valuable lesson in ensuring all emails to be written in a formal manner